Catastrophic Claims Adjuster Providers for Quick Settlements

Exactly How a Catastrophe Adjuster Can Maximize Your Insurance Case

Navigating the complexities of an insurance claim adhering to a disaster can be overwhelming, especially when attempting to make certain a fair settlement. A catastrophe insurer possesses the expertise to improve this process, offering useful insights that can considerably enhance your case's end result.

Comprehending Catastrophe Adjusters

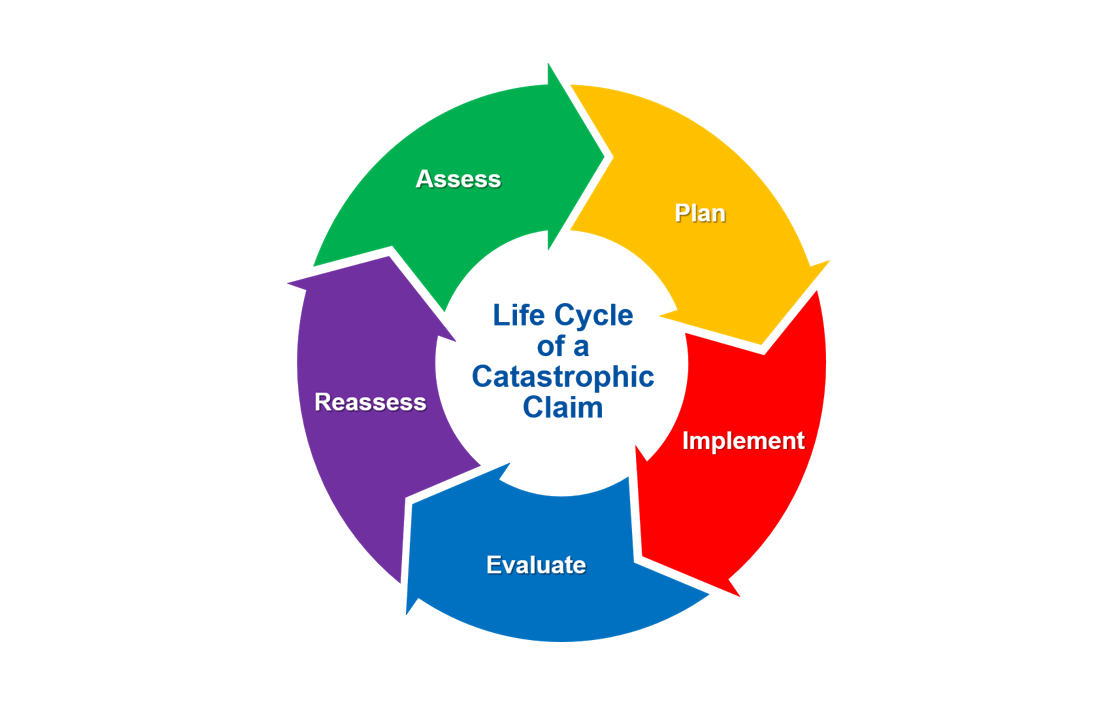

Catastrophe adjusters play an important duty in the insurance coverage claims process, specifically in the after-effects of significant disasters. These experts specialize in examining damages resulting from tragic events such as hurricanes, floods, fires, and quakes. Their competence is vital for precisely evaluating the degree of losses and figuring out proper settlement for insurance holders.

A catastrophe insurer commonly possesses specialized training and experience in disaster-related cases, enabling them to navigate the complexities of insurance coverage and local regulations. They perform comprehensive inspections of harmed buildings, put together comprehensive reports, and collect sustaining documentation to substantiate insurance claims. This process frequently entails working carefully with insurance holders, professionals, and various other stakeholders to make certain a comprehensive evaluation is finished.

Along with examining physical damages, disaster adjusters additionally think about the psychological and economic effect on affected individuals, providing guidance throughout the cases procedure. Their unbiased perspective helps maintain justness and openness, guaranteeing that policyholders receive the advantages they are qualified to under their insurance coverage plans - catastrophic insurance adjuster. Understanding the role of catastrophe insurance adjusters is necessary for insurance holders seeking to maximize their claims, as their experience can considerably influence the result of the insurance claims process

Advantages of Employing a Disaster Insurance Adjuster

Working with a catastrophe adjuster can supply substantial advantages for policyholders navigating the cases procedure after a disaster. These experts concentrate on analyzing damages from disastrous occasions, guaranteeing that the examination is exact and extensive. Their knowledge permits a thorough understanding of the complexities included in insurance coverage cases, which can typically be frustrating for policyholders.

One of the main advantages of hiring a catastrophe adjuster is their capacity to maximize insurance claim negotiations. Their expertise of sector requirements and practices enables them to support successfully in support of the insurance policy holder, guaranteeing that all eligible problems are documented and valued properly. This advocacy can lead to higher economic recovery than what an insurance holder could achieve on their very own.

Additionally, catastrophe adjusters bring neutrality to the cases process. They are not psychologically bought the after-effects of the catastrophe, permitting them to evaluate problems right. Moreover, their experience in working out with insurer can quicken the claims procedure, minimizing hold-ups that typically happen when policyholders handle cases individually.

Inevitably, engaging a disaster adjuster can ease the burden of browsing a complicated insurance coverage landscape, providing tranquility of mind during a difficult time.

The Claims Refine Discussed

)

After your insurance claim is filed, an insurance policy adjuster, frequently a disaster insurer in severe cases, will certainly be appointed to evaluate the damages. This professional will certainly assess the extent of the loss, evaluate your policy for coverage, and identify the appropriate settlement. It is very important to record the damages completely, including photos and a thorough stock of lost or damaged products.

The insurance provider will after that evaluate the insurance claim and communicate their choice concerning the payout. Throughout this process, keeping clear communication with your insurance adjuster and recognizing your plan will dramatically enhance anonymous your ability to navigate the insurance claims procedure effectively.

Usual Errors to Stay Clear Of

Browsing the insurance policy asserts procedure can be tough, and avoiding usual challenges is important for maximizing your payment - insurance claims recovery. One prevalent blunder is falling short to document damages thoroughly. Without correct evidence, such as pictures and in-depth summaries, it comes to be tough to confirm your claim. Additionally, overlooking to keep documents of all interactions with your insurer can bring about misunderstandings and complications down the line.

Another typical error is taking too lightly the timeline for submitting a claim. Lots of plans have strict due dates, and hold-ups can result in denial.

Additionally, neglecting plan information can impede your case. Acquainting on your own with coverage limitations, exemptions, and particular demands is vital. Last but not least, falling short to look for professional aid can substantially influence the end result. A catastrophe insurance adjuster can offer vital assistance, guaranteeing that you prevent these risks and browse the cases procedure efficiently. By identifying and avoiding these typical mistakes, you can dramatically improve your possibilities of obtaining a ample and fair settlement.

Picking the Right Insurance Adjuster

When it pertains to maximizing your insurance coverage case, selecting the ideal insurance adjuster is a crucial action in the process. The adjuster you select can dramatically influence the outcome of your insurance claim, influencing both the speed of resolution and the quantity you obtain.

Next, consider their reputation. Look for testimonials or testimonials from previous customers to gauge their reliability and performance. An excellent insurance adjuster needs to communicate clearly and give normal updates on the development of your insurance claim.

Conclusion

In final thought, engaging a disaster insurance adjuster can substantially improve the possibility for a desirable insurance policy claim outcome. Their proficiency in navigating complex policies, performing detailed inspections, and properly discussing with insurer ensures that policyholders obtain fair payment for their losses. By preventing typical challenges and leveraging the insurance adjuster's specialized understanding, people can optimize their insurance claims and alleviate the burdens linked with the cases process, dig this inevitably bring about a more sufficient resolution in the aftermath of a disaster.

Disaster adjusters play an essential function in the insurance coverage declares procedure, particularly in the results of significant disasters. Understanding the function of catastrophe insurance adjusters is essential for policyholders seeking to optimize their insurance claims, as their expertise can significantly influence the end result of the cases procedure.

Their experience in working out with insurance coverage firms can accelerate the insurance claims procedure, minimizing hold-ups that commonly try this website take place when policyholders handle insurance claims independently.

After your insurance claim is submitted, an insurance insurer, frequently a disaster insurer in serious instances, will certainly be assigned to evaluate the damages. By preventing common mistakes and leveraging the adjuster's specialized knowledge, individuals can maximize their cases and ease the problems linked with the cases process, inevitably leading to a much more adequate resolution in the after-effects of a catastrophe.